| Company Name | EY |

| Job Role | Associate Analyst – TAX – AMI – Indirect Tax – Core |

| Qualification | Graduate/Postgraduate |

| Experience | Freshers |

| Salary | 3.8 – 9 LPA (via AmbitionBox) |

| Location | Ahmedabad |

About EY

EY is a global leader in assurance, tax, transaction, and advisory services. We believe in empowering people with the right training, opportunities, and creative freedom to grow. At EY, your career is truly yours to build—and we provide the platform for you to achieve your best professional self.

The Opportunity

We are seeking an Associate Analyst – TAX – AMI – Indirect Tax – Core to join our team in Ahmedabad.

The role focuses on Advanced Manufacturing, Mobility & Infrastructure (AMI) industries such as aerospace, defence, automotive, transportation, chemicals, and industrial products—helping clients tackle evolving business challenges with cross-sector collaboration.

Within Indirect Tax – Core, our teams help businesses navigate global tax policies and regulations, leverage transformative technologies, and deliver strategies that reduce risk while driving sustainable value.

Key Responsibilities

- Provide corporate advisory support and draft/vet commercial agreements (vendor contracts, employment agreements, lease deeds, etc.).

- Advise on legal and compliance issues related to corporate, commercial, and labour laws, including statutory filings and approvals.

- Issue legal opinions and memorandums across industries.

- Collaborate on mergers, acquisitions, and private equity transactions.

- Contribute to legal due diligence exercises.

- Draft and review transaction documents (shareholder agreements, JV agreements, escrow agreements, term sheets, etc.).

- Stay updated with legal and regulatory developments.

Skills & Attributes

- Strong analytical and problem-solving skills.

- Ability to work collaboratively across teams and client departments.

- Agile, curious, adaptable, and innovative mindset.

- Positive energy with the ability to manage complex challenges.

Qualifications

- Graduate/Postgraduate in Economics, Engineering, Mathematics, Statistics, or MBA.

Experience

- Prior knowledge/experience in GST, Customs, or earlier indirect taxation regimes (Sales Tax, Service Tax, Central Excise) is desirable.

What We Offer

- A chance to work with 300,000 EY professionals worldwide, including 33,000 in India.

- Exposure to global clients, entrepreneurs, and visionaries.

- Personalized career journeys and access to EY’s learning frameworks.

- An inclusive and balanced work environment focused on career growth and wellbeing.

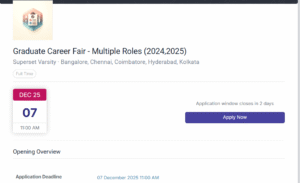

How to Apply

After checking all the Responsibilities, skills & eligibility criteria, if you are interested and eligible for this role. Then, do apply by the following link

Click Here To Apply For The Job: Apply Now

Join GetJobCatalyst on Telegram for Daily Job Alerts & Career Tips : Join Now